how to do tax relief

Early Termination of the. To illustrate the US.

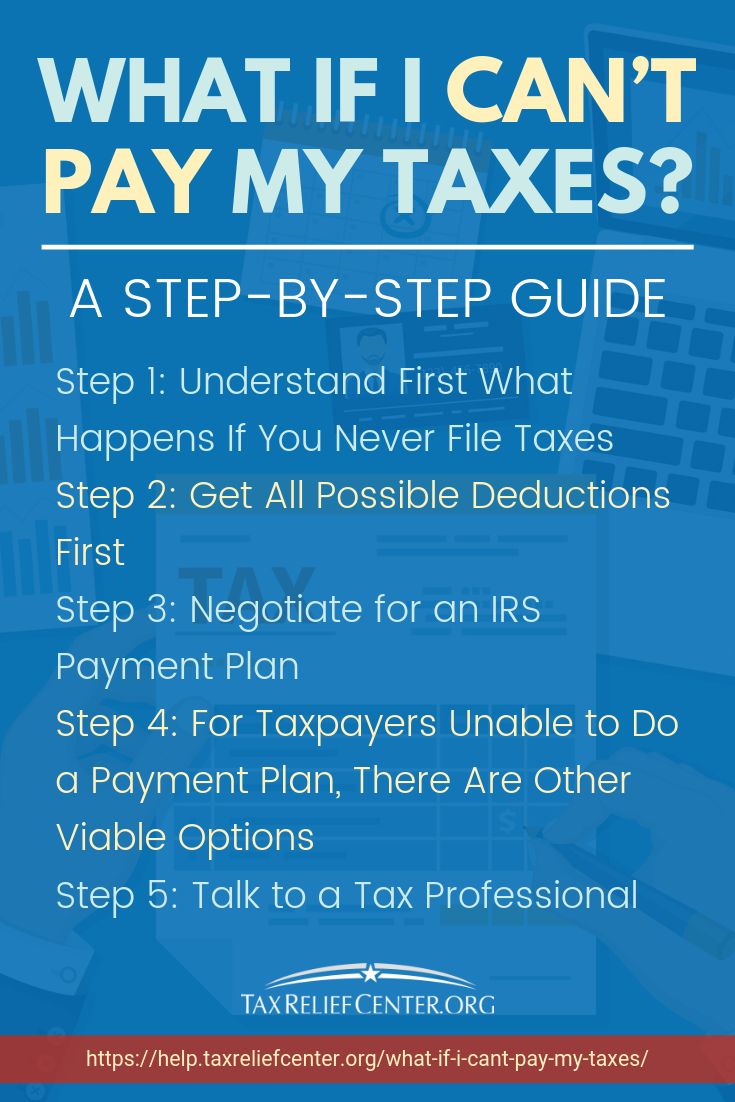

What If I Can T Pay My Taxes By April 15 Tax Relief Center Business Tax Accounting Humor Tax Prep Checklist

The first step of tax relief is preparation.

. Review our Top 10 Tax Relief Companies. What Is Tax Relief. It was established in 2000 and has been a member of the.

Your small or large business or tax-exempt organization may be eligible for coronavirus relief. 15 hours agoThe latest breaking updates delivered straight to your email inbox. Ad We Reviewed the Top Tax Relief Service Providers for You to Settle Your Bill with the IRS.

Solve All Your IRS Tax Problems. Tax relief is any program or incentive that reduces the amount of tax owed by an individual or business entity. The federal tax filing deadline for 2020 taxes has been automatically extended to May 17 2021.

Fortress Tax Relief is best for a large amounts of debt because of its hourly rate. First time abatement relief is also available for the first time a taxpayer is subject to one or more of these tax penalties. Only a tax resident including non-Singapore Citizens who are in Singapore for more than 183 days in a year can claim for tax relief.

Examples of tax relief include the allowable deduction for pension. We Collected Compared The Top Tax Relief Companies For You To Save Your Money. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Get tax back or get it. Provide Tax Relief To Individuals and Families Through Convenient Referrals. For individual taxpayers receiving notices letters about a.

This relief does not always imply that you have no monetary responsibility to the IRS. Larson offers free consultations but does require you to have a minimum of 20000 in tax debt to take on your case. Self-Employed Filing and Payment Deadlines.

About the Company How Do Tax Relief Programs Work. Here is how reputable tax relief companies work. Due to severe winter storms the IRS.

Tax relief is a relief in the amount of money you owe to the IRS in the form of taxes. Median property tax paid is about 2000 annually or about 1 of the. With companies that charge a percentage-based fee you would likely spend a lot more if you.

The IRS calculates each tax years standard deduction value and income requirements based on filing status and inflation so it typically changes on an annual basis. Expert Reviews Analysis. Starts at 300.

Unlike refunds though you dont necessarily have to overpay your taxes. A tax rebate returns to the taxpayer a portion or sometimes even all of a certain tax they paid in a year. To be able to qualify for a long-term repayment plan which is considered over 120 days or longer you must owe 50000 or less in combined taxes interest and penalties.

End Your Tax NightApre Now. Gather your paperwork including. Pay less tax to take account of money youve spent on specific things like business expenses if youre self-employed.

Unless you are an expert in tax laws it can be a complex and time-consuming task to understand them. 2021 Federal and State Tax Filing Deadlines. Other earning and interest statements 1099 and 1099-INT forms Receipts for.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. Trusted by Over 1000000 Customers. The Oklahoma House of Representatives has passed bills to help Oklahomans get some relief from sky-high.

About the Company How To Get Irs Tax Relief. Steps to File a Tax Return. According to Larson it charges a minimum fee of.

Anthem Tax Services offers both IRS tax debt relief and corporate tax preparation services. Review our Top 10 Tax Relief Companies. Tax relief is often achieved through new rules that reduce how much you owe in taxes such as by providing a tax exemption or a tax credit.

Ad BBB A Rating. To accelerate the economic recovery and deliver relief to New Yorkers Governor Hochul will. Yes filing an application for a property tax exemption can save you a lot of money.

Ad Compare the Best Tax Relief Services Get Help from a Qualified Professional Experts. Tax relief means that you either. Ad Based On Circumstances You May Already Qualify For Tax Relief.

It was established in 2000 and has been a member of the. Professional tax preparers help your tax account minimize liability without evading your taxes. A W-2 form from each employer.

1 It may also be done through rules. The company helps you apply for all IRS tax debt relief. Ad Honest Fast Help - A BBB Rated.

Ad Do You Owe Over 10K in Back Taxes to the IRS. Get Tax Relief from Top Tax Relief Services. Here are four common options that could help you find some relief plus guidance on how to file back taxes and how many years you can file back taxes for.

- As Heard on CNN. CuraDebt is an organization that deals with debt relief in Hollywood Florida. Ad We Reviewed the Top Tax Relief Service Providers for You to Settle Your Bill with the IRS.

100 Money Back Guarantee. Provide 100 Million of Relief for 195000 Small Businesses. Ad 5 Best Tax Relief Companies of 2022.

Please check if you have met the qualifying. Tax relief really means setting up a payment plan or negotiating a settlement with the IRSits not about erasing your tax obligation. You can avoid tax liabilities that do not.

What Tax Forms Do I Need To File For An Llc Tax Relief Center Llc Taxes Tax Forms Filing Taxes

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help

Know Your Worth Then Add Tax Taxreliefcenter Inspiration Preparing For Retirement Best Money Saving Tips Tax Prep

Irs Penalty Calculator Infographic Tax Relief Center Irs Making A Budget Business Tax

What Can You Write Off On Your Taxes Infographic Tax Relief Center Infographic Tax Help Tax

What To Look For In The Best Tax Relief Companies Tax Debt Tax Debt Resolution

Tax Debt Forgiveness Frequently Asked Questions Tax Relief Center Debt Forgiveness Tax Debt Debt

Delinquent Taxes Infographic How To Pay Off Or File Late Taxes Tax Help Tax Money Management

What Is An Irs Tax Offset And How Do You Recover It Tax Relief Center Irs Taxes Tax Help Tax Debt

Irs Offer In Compromise Infographic 3 Reasons To Not Pay Taxes Offer In Compromise Business Tax Deductions Irs Taxes

Irs Form 5329 For Retirement Savings And More Tax Relief Center Saving For Retirement Irs Forms Health Savings Account

Settle Your Irs Tax Debt Pay Just A Fraction Take 1 Minute See How Much We Can Save You Www Tax Relief Us Com Save Money Just In Case

How Do Education Tax Credits Work Tax Relief Center Online Education Education Tax Credits

We Help Taxpayers Get Relief From Irs Backtaxes Do You Qualify For Irs Back Tax Relief Get A Free Review Free Tax Help Online Assessments Money Management

Premium Tax Credit Whattaxpayers Need To Know Tax Relief Center Best Health Insurance Affordable Health Insurance Health Insurance

Tax Debt Consolidation Everything You Need To Know Tax Relief Center Tax Debt Debt Consolidation Eliminate Debt

What Is The Irs Tax Audit Process Tax Relief Center Irs Taxes Audit Tax Debt